Build Your Knowledge

Build your HR and payroll knowledge with the latest news and tools intended to help you and your employees.

Blog

Read our blog for relevant HR information as well as all the latest news from ECCA Payroll+.

States

View information for the withholding requirements, new hire filings, and much more for each state.

Calculators

Use these convenient paycheck calculators to learn more about your pay and taxes, including a Form W-4 Wizard.

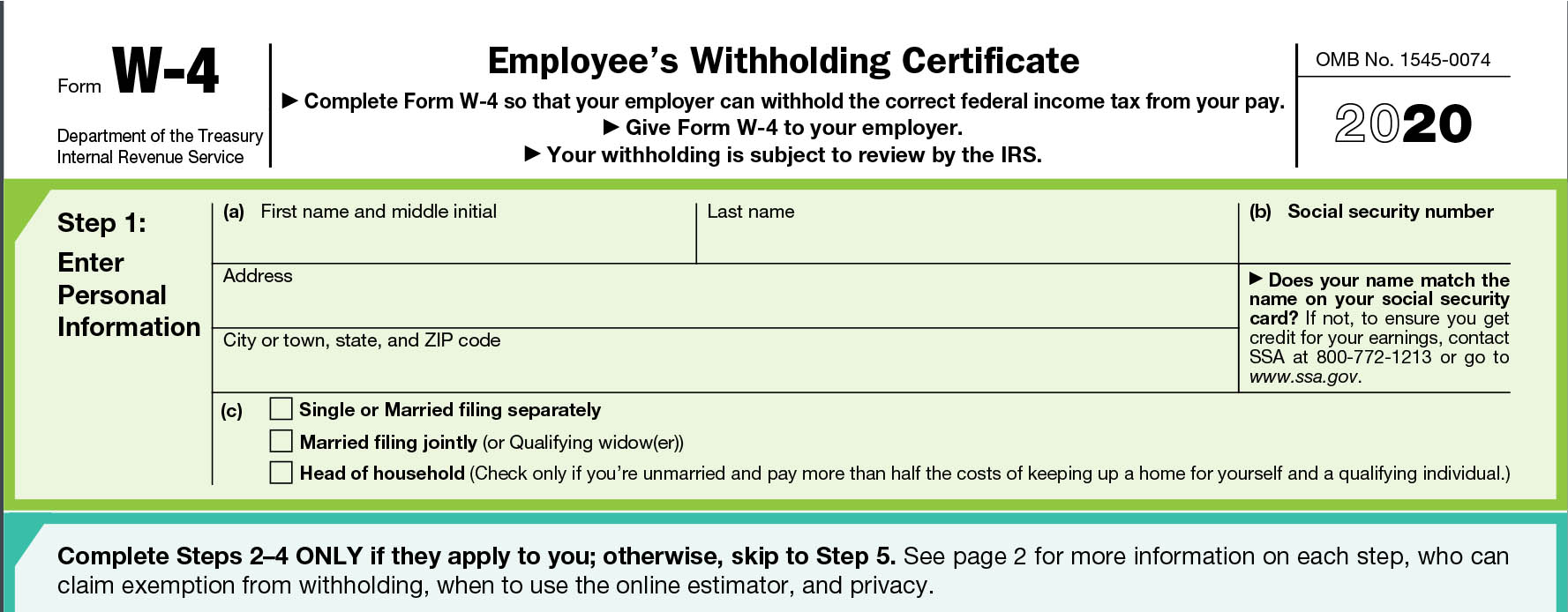

The Form W-4 Info Stack

In January 2020, the IRS introduced a revised Form W-4. In this new version, the IRS removed withholding allowances. As a result of changes in the tax code, you can no longer claim personal exemptions; the withholding allowances were tied to these exemptions.

This free infographic explains the different sections of the redesigned Form W-4. Download and share it with your employees today!