Full-service payroll including federal, state, and local tax filing

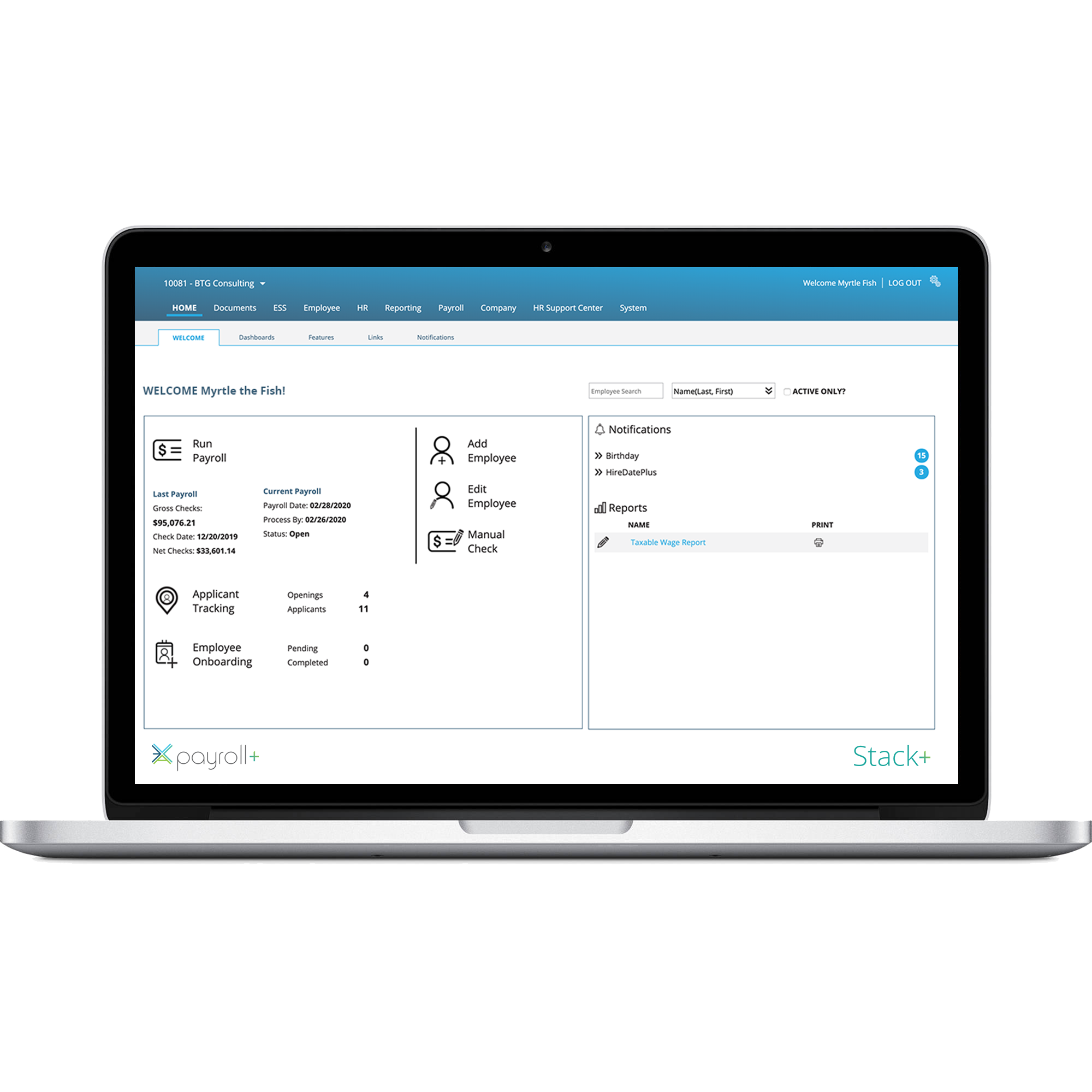

Payroll and taxes no longer need to be complicated and overwhelming. With powerful yet easy-to-use software along with personalized support, ECCA Payroll+ simplifies your payroll processing and makes it easy for you to pay your employees accurately.

Tax Filing + Compliance

ECCA Payroll+ alleviates the difficulties of filing federal, state, and local taxes and ensures you remain compliant with ever-changing tax laws. The ECCA Payroll+ system is routinely updated to reflect any changes in the tax code at any level.

Time-off Accruals

With ECCA Payroll+, you have the flexibility to set rules that determine how paid time-off is accrued. Each accrual code you set up can accrue or reduce based on a defined set of earning codes.

I would highly recommend ECCA Payroll+ to anyone looking for a dedicated, responsible and responsive payroll company capable of growing with your business needs.

I would highly recommend ECCA Payroll+ to anyone looking for a dedicated, responsible and responsive payroll company capable of growing with your business needs.