Share This Page

Form W-4 Info Stack

As a result of recent changes in the tax code, the IRS redesigned Form W-4, the Employee's Withholding Certificate. The new design went into effect in January 2020. This Form W-4 Info Stack is a collection of resources intended to help you and your employees adjust to the new form.

The IRS had two primary objectives with the Form W-4 redesign.

Simplicity

The IRS aimed to reduce the complexity of the original form, making it easier for individuals to complete. To achieve this result, the IRS reduced the dependance upon complex worksheets. Instead, the new Form W-4 uses direct questions to calculate an accurate withholding amount.

Accuracy

While you could account for multiple jobs in the prior version, the new form is more direct. This applies to individuals with multiple jobs and married couples where both spouses work. By accounting for all sources of income, the amount of tax withheld from each pay check is more accurate.

Form W-4 Key Sections

Required

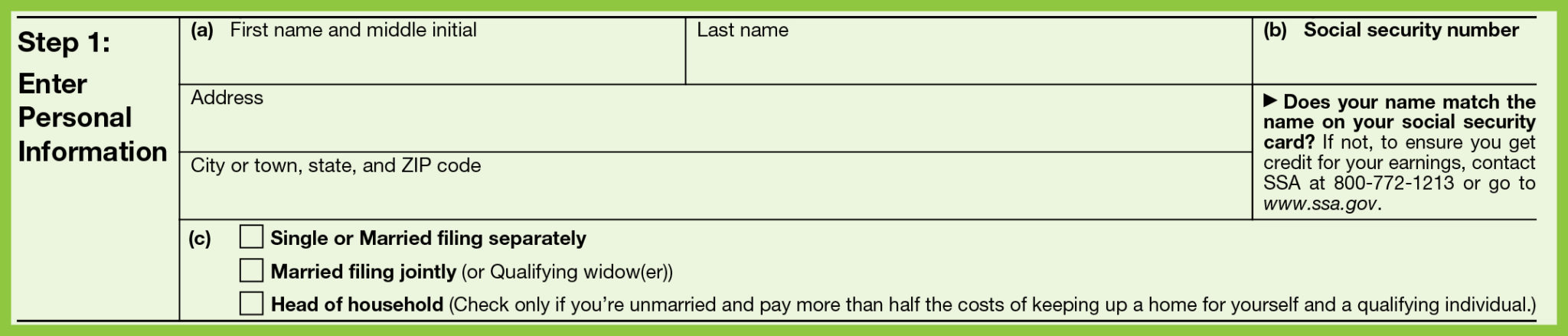

1. Demographics

Your personal information, such as name, address, and social security number. The new Form W-4 introduces a new filing status – Head of Household.

Optional

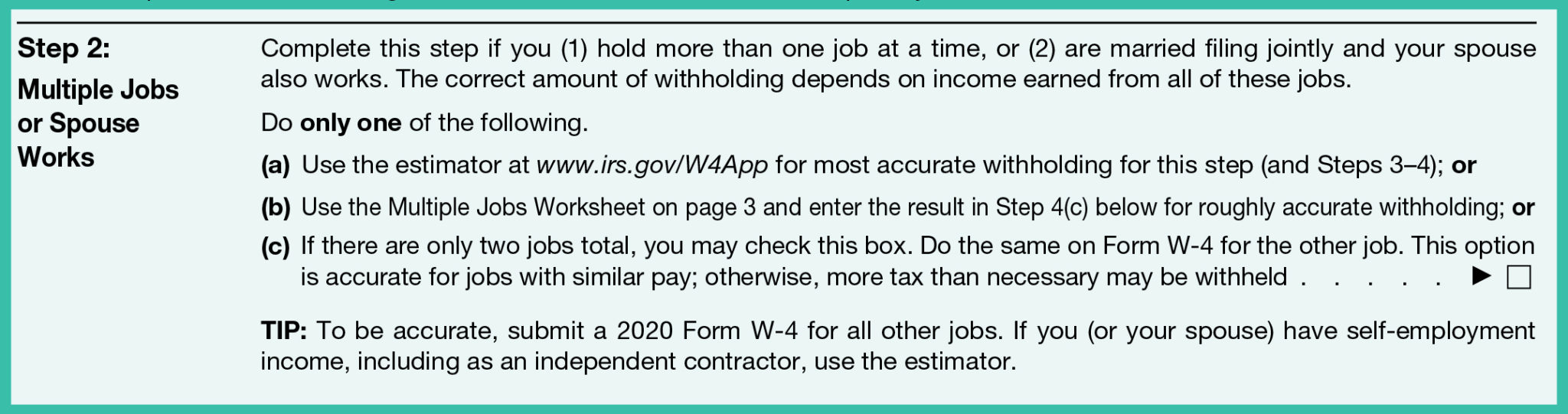

2. Multiple Jobs

This section is for individuals who hold more than one job at a given time or who have a filing status of Married, filing jointly and the spouse is also employed.

If Married, filling jointly, each spouse should select the check box in Step 2 (c). However, only one spouse should complete Steps 3 through 4 (b). For the sake of accuracy, these steps should be completed on the Form W-4 for the higher paying job.

Optional

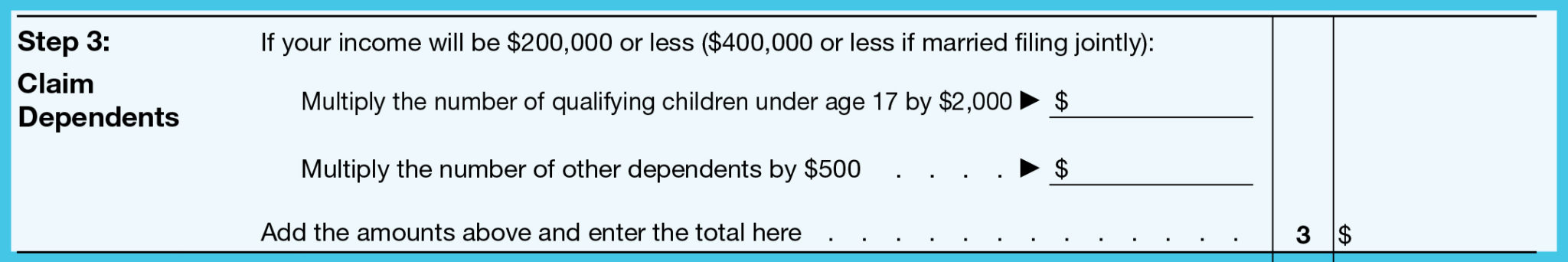

3. Dependents

If you are claiming any dependents, such as children, complete this section. Previously, you would simply enter the number of allowances. However, as part of the redesign, you will use the number of dependents to calculate an actual dollar amount.

Optional

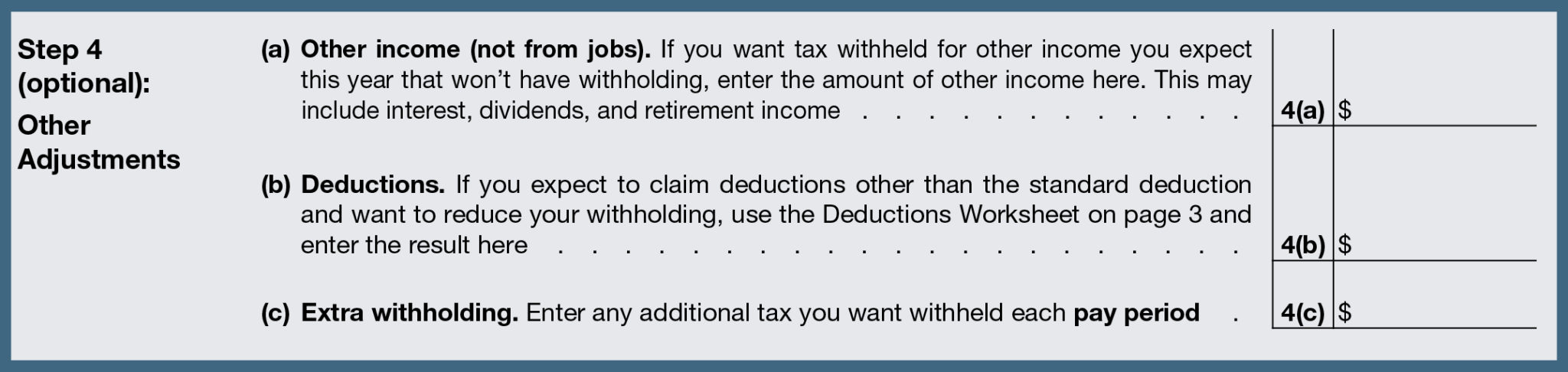

4. Other Adjustments

Complete this section if you have other income outside of your job(s), such as interest or dividends; are claiming non-standard deductions (e.g. student loan interest); or want to have additional tax withheld from your paycheck.

If you are claiming additional deductions, refer to Page 3 of the Form W-4 to see how to calculate this amount.

FAQs

You don't.

Withholding allowances were tied to personal exemptions. Because of changes in the tax code, you can no longer claim personal exemptions. As such, the withholding allowances were removed from Form W-4.

No.

Employees are not required to resubmit Form W-4 because of the redesign. As such, employers should continue to withhold tax based on the information provided on the employee’s most recently submitted Form W-4.

Employees should use the new Form W-4 with regards to wages paid in 2020 and later.

You can. However, as part of the request, you should explain that:

- they are not required to submit a new Form W-4, and

- if they do not submit a new one, that employee's withholding will continue based on the previously submitted Form W-4.

Yes.

To claim exemption from withholding:

- Complete Steps 1(a) and 1(b).

- Write Exempt in the space below Step 4(c).

- Sign the form.

The IRS produces Publication 15-T that details the steps to calculate the federal income tax withholding (FITW). There are two methods - the Percentage Method and the Wage Bracket Method. The Wage Bracket Method is a simpler process but is only applicable for earnings up to $100,000 annually.

YES!

Stack+ was updated to take into account the new Form W-4. Simply contact us and the ECCA Payroll+ support staff will be in touch to walk you through the steps to record this new information.

Resources

Blog

IRS Redesigns Form W-4

Read the latest blog post detailing the changes in the W-4.

Form W-4

Download a fillable copy of the new Form W-4.

IRS

Federal Income Tax Withholding Methods

Use the steps detailed in this document to manually calculate an employee's FITW.

Calculator

Form W-4 Wizard

Use this Form W-4 wizard to help complete the form.

IRS

Tax Withholding Estimator

Use this tool from the IRS to determine how best to complete Form W-4.