Full-service payroll including federal, state, and local tax filing

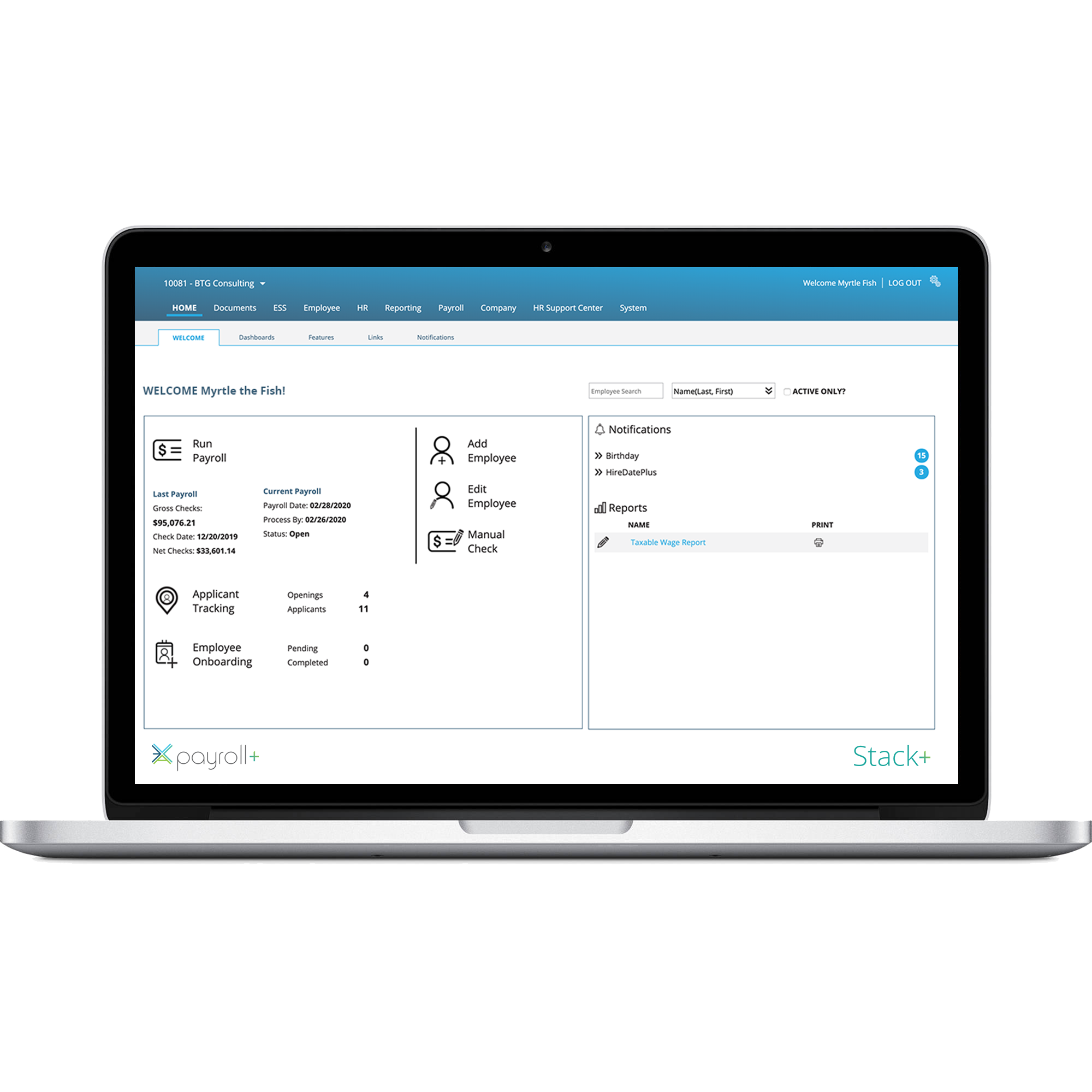

Payroll and taxes no longer need to be complicated and overwhelming. With powerful yet easy-to-use software along with personalized support, ECCA Payroll+ simplifies your payroll processing and makes it easy for you to pay your employees accurately.

Tax Filing + Compliance

ECCA Payroll+ alleviates the difficulties of filing federal, state, and local taxes and ensures you remain compliant with ever-changing tax laws. The ECCA Payroll+ system is routinely updated to reflect any changes in the tax code at any level.

Time-off Accruals

With ECCA Payroll+, you have the flexibility to set rules that determine how paid time-off is accrued. Each accrual code you set up can accrue or reduce based on a defined set of earning codes.

Our Western Pennsylvania Save a Lot grocery stores have been using ECCA Payroll+ services since 2010. As we have expanded to more locations, ECCA Payroll+ has met our needs. Online payroll, electronic time clocks, ACA hour tracking and projections, reporting, government report filings, etc. are only fraction of the many items they offer.

Our Western Pennsylvania Save a Lot grocery stores have been using ECCA Payroll+ services since 2010. As we have expanded to more locations, ECCA Payroll+ has met our needs. Online payroll, electronic time clocks, ACA hour tracking and projections, reporting, government report filings, etc. are only fraction of the many items they offer.